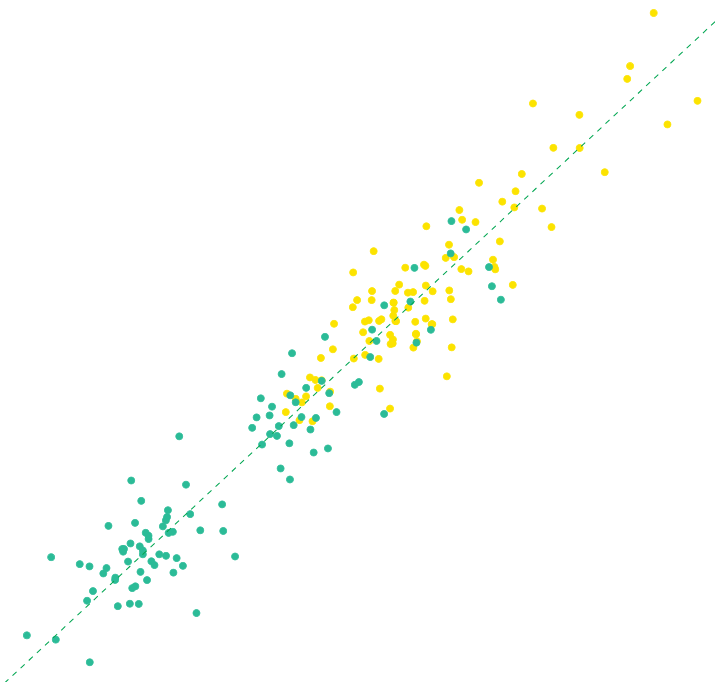

The nonlinear properties of described in Chapter II, which can be thought of a type of memory function, arise from its intrinsic dependence on past values of

. This means that for some integer-time stochastic process

our model satisfies one of two relations: a Submartingale defined by

or a Supermartinagle defined by

The focus of this chapter will be to explore the fundamental stochastic characteristics of (28) using the above defintions. To begin, it will help to re-write the integral using summation nation:

Note that when we have

.

In order to address these non-deterministic integrals in (31) we will need to apply Itô’s Lemma expressed as

For we have

which yields

The case will require a little more mathematical machinery. The first step is to re-write the integral using Itô’s Differential:

The quadratic covariation denoted by underpins a critical difference between classical calculus and stochastic calculus. This topic is quite involved and, for the sake of brevity, will be skipped in this chapter. I plan to return to it in the future with a comprehensive overview. Continuing on, we know that using Itô’s multiplication table we can deduce that

, where

is the Kronecker delta and where

when

. The expression can then be re-written as

Applying Itô’s product rule to:

we can derive:

Integrating both sides in (36):

Since , we have

, so:

Rearranging (38) and solving for :

Provided that , we can isolate

:

Given that the closed form solution to , we can also write:

Finally we have: