To effectively elucidate the causal relationships between various economic processes, it is vital to delineate the evolution of their patterns. For example, recent developments in interest rates highlight the potential correlations among different rates. The onset of global trade tensions, initiated by former President Trump’s policies, has prompted notable adjustments, including reductions in rates by various countries due to decisions made by international institutions such as the European Central Bank (ECB) (see https://www.lesechos.fr/finance-marches/marches-financiers/la-bce-choisit-de-baisser-ses-taux-face-a-lincertitude-economique-2160609). Additionally, the Federal Reserve (FED) is facing pressure to lower its rates in response to these external influences (https://www.marketwatch.com/story/trump-is-furious-that-fed-wont-cut-interest-rates-like-ecb-heres-why-powell-wont-budge-162dfdaa).

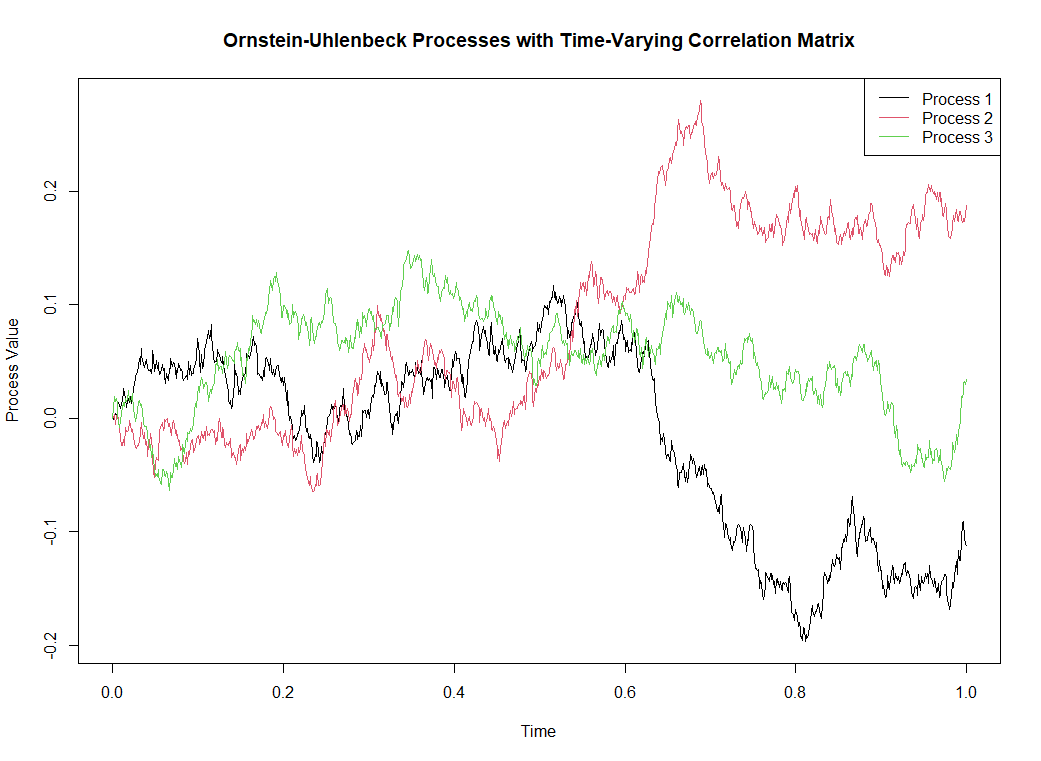

A straightforward approach to modeling the evolution of interest rates is through stochastic processes, such as the Ornstein-Uhlenbeck process. Although potential negative rates present a challenge, our focus will be on further exploring multivariate scenarios. Should it be imperative to avoid negative rates, the Heston-White model presents a viable alternative. For a thorough examination of interest rate modeling, refer to the comprehensive work of Damiano Brigo and Fabio Mercurio.

In the following, we are interested in the stochastic differential equation of the form

where the second term shall be generalized. But what generalization?

We thus introduce the vector stochastic processof dimension

(

interest rates),

is a

matrix describing the trends of the vector stochastic processes.

In other posts of the present blog, the following equation was proposed.

whereis a function, assumed to be at least continuous on

(or

-Borelian, or "Borealian" to be more precise). In addition,

is assumed to be some positive number. Finally,

is a vector of standard Wiener processes. The function

is giving non-linearities and further depenencies

First, we note that this equation gives

This means thatis a sum of linear forms (i.e. "

") defining some metric of integration. Since

and

are the only forms which we consider in this equation, then we heuristically we:

where the's are Borealian functions of

and

and we ignore the terms of the form

with

, and

with

. Considering now the fact that

is only depending on

, this means that the term of the form

could be set to zero. Thus we have:

Using again the fact thatonly depends on

, we should have

where the's are other Borelian functions but only depending on

(and

). Repporting to Eq. (1), we then have:

This (vector) equation turns out to be the most possible general stochastic differential equation related to the functionintroduced in Eq. (1). Note here that

is a vector of dimension

and

is a matrix of dimension

, representing the covariance matrix associated with the vector

. In fact, this equation is an Itô process.

If the processes only have dependencies in their stochastic terms, we shall setto be a vector only depending on time

, i.e.

, so that the final quation of interest is given by:

We integrate this equation by setting:

The Itô's lemma gives:

Therefore, integration of this process finally leads to:

Now, we note that the only random term is the third one, which has zero expected value. Therefore, we have

In words,is following a normal vector process with covariance

. It shall be interesting to see in which circumstances the matrix

and vector

may lead to a non-explosive process.